May 2024

It is well understood that small firms are riskier, on average, than large firms, and that smaller firms have, on average, lower valuation market multiples. Of course, one would expect large firms to have higher values than small firms due to their ability to generate higher levels of earnings and that the higher risk of smaller firms results in higher valuation discount rates. The question then is how much higher are discount rates for small firms than for large firms. This can be answered by looking to data published by the Center for Research in Security Prices, LLC as shown below.

|

Although not perfect, the above table shows a distinct correlation between market capitalization and size premium with a low of 0.5% for decile 2 to 4.7% for decile 10.

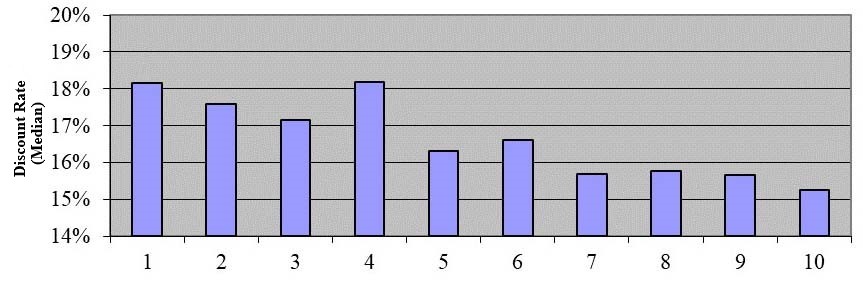

The below breakout of decile 10 (the smallest) also shows a tendency for the smaller firms to have higher discount rates than for larger firms.

|

To test this, we divided 1,067 profitable publicly-traded companies into deciles according to their market capitalizations. Decile 10 included companies with the highest market capitalizations ($101.40 billion and greater) and Decile 1 represented the companies with the smallest market capitalizations ($43.60 million to $1,478.39 million). We then calculated the median discount rate of each decile. The graph below shows that larger companies tend to have lower discount rates. Companies in Decile 10 (the largest) had a median discount rate of 15.3%, while Decile 1 (the smallest) had a median discount rate of 18.1%. Presumably even smaller companies would have even higher size premiums.

| Discount Rates & Market Capitalizations of Publicly-Traded Companies As of 12/31/2023 |

|

It should be noted that, although it is evident that smaller companies on average have higher risk premiums than larger companies, a specific smaller company may have an overall lower risk level as other factors are at play in determining a reasonable discount rate.

When using size premia to value a private company it should be noted that the sizes of the companies utilized in the foregoing tables were derived from their market capitalizations (publicly-traded price per share times shares outstanding). In order to utilize the risk premia data to value a private company its market capitalization needs to be estimated in order to determine what level of risk premia is applicable. An iterative process may be necessary in order to ensure that the value of the company after utilizing the risk premia data is still in the same size range utilized before utilization of the risk premia to establish value.

Relevant Court Cases

-

Kemmet v. Kemmet,

Supreme Court of North Dakota,

2024 ND 65,

filed April 4, 2024

-

Sneed v. Sneed,

Court of Appeals of North Carolina,

No. COA23-446,

filed May 7, 2024

Recent Business Valuation Articles

-

“Three Models of the Liquidity Premium,”

by Jamil Baz, Lloyd Han and Marc-Antoine Loo,

posted March 2024

-

“Delta Least Squares Monte Carlo

Pricing of American Options,”

by Peter Pommergard Lind and Rolf Poulsen,

posted April 9, 2024

Recent Engagements

- Valuation of 100% of the common

stock of a manufacturer of industrial

maintenance products, on a controlling

interest basis for corporate planning

purposes.

- Valuation of a limited partnership

interest of a hotel holding limited

partnership on a minority interest

basis for gift tax reporting purposes.

- Valuation of the common stock of

a construction and service company

providing HVAC solutions on a

controlling interest basis for

Employee Stock Ownership Plan purposes.

- Valuation of the common stock of

a holding company of an industrial

equipment supplier on a minority

interest basis for gift tax

reporting/sale purposes.

";

"

";

" ";

"

";

" ";

"

";

" ";

"

";

" ";

"

";

" ";

";